Newly updated "Small Business Capital" programs provide federal grants in California

An updated list of federal Small Business Capital grants in California highlights new opportunities for small businesses seeking financial support.

As of early April, 2025, the California Office of the Small Business Advocate (CALOSBA) has no active grant programs at the state level. However, California small businesses can now tap into a newly updated list of federal Small Business Capital grants in California, offering a range of financial resources to support recovery, growth, and innovation.

Below is a quick breakdown of the available programs now listed by CALOSBA:

1. Disaster Assistance Grants and Loans

Entity: Small Business Administration (SBA)

This program supports businesses located in federally declared disaster areas. It covers losses that weren’t reimbursed by insurance or FEMA, and it helps cover normal operating expenses that would have been met if the disaster had not occurred.

➡️ Use Case: Ideal for small businesses impacted by wildfires, floods, or other natural disasters across California.

2. Investment Capital via Small Business Investment Companies (SBICs)

Entity: Small Business Administration (SBA)

These are privately owned investment firms licensed and regulated by the SBA. SBICs use both private capital and SBA-guaranteed funds to invest in small businesses through debt or equity financing. While the SBA does not directly invest in businesses, it enables this funding by supporting qualified SBICs.

➡️ Use Case: Great for startups or expanding businesses seeking long-term investment with sector-specific expertise.

3. Research & Development (R&D) Grants

Programs: SBIR & STTR

These federal R&D-focused grants are designed to stimulate innovation among startups and small businesses in high-tech fields. They help companies meet federal research needs while encouraging commercialization of new technology.

➡️ Use Case: Perfect for tech startups and small businesses working in advanced sciences or engineering with scalable, innovative solutions.

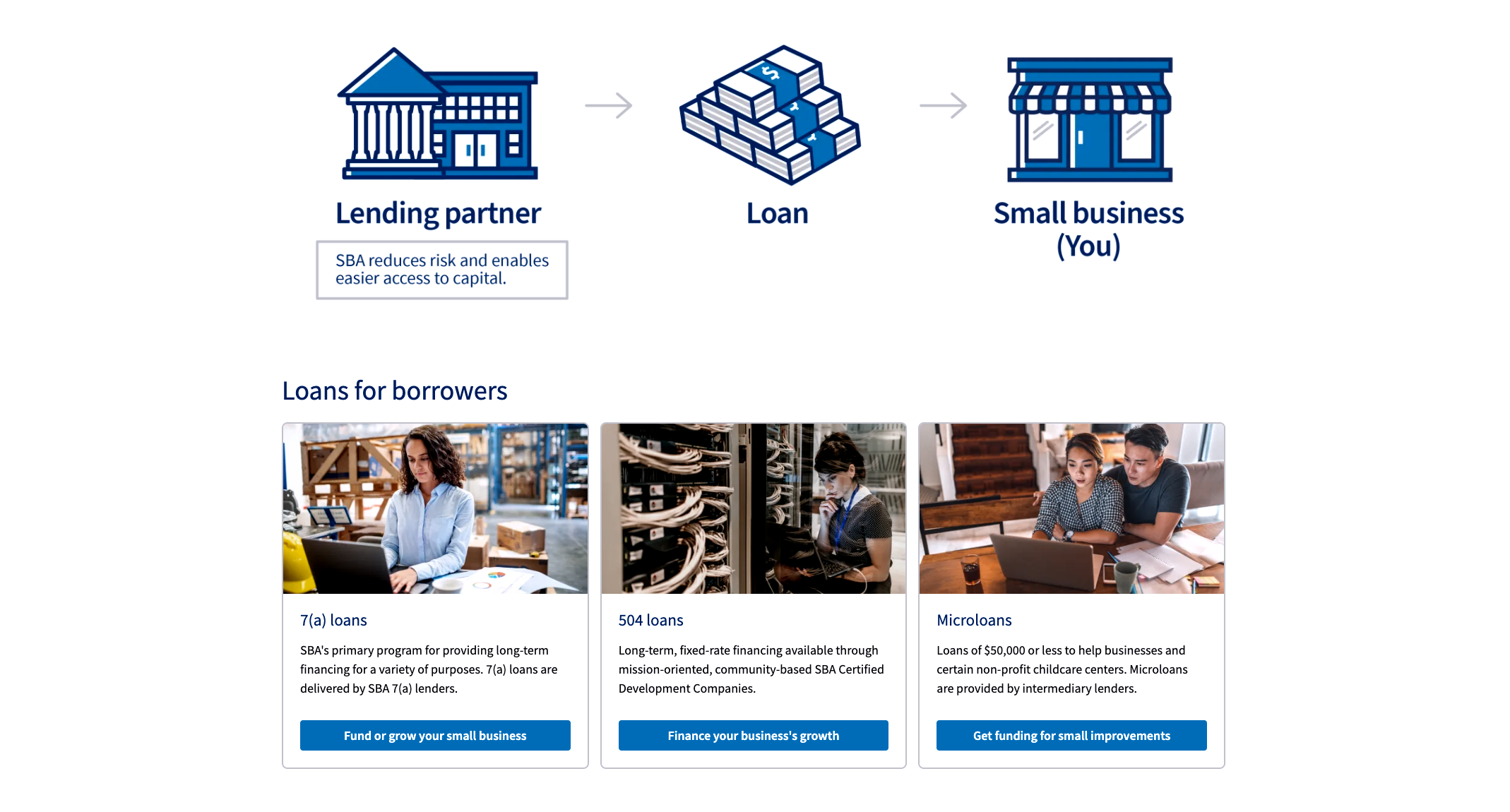

4. SBA-Backed Loans

Programs: 7(a), 504, and Microloans

While not direct business grants, these loan programs reduce lender risk and improve access to capital for small businesses. Options include the 7(a) program for general purposes, 504 loans for real estate and equipment, and microloans up to $50,000 for smaller needs.

➡️ Use Case: Useful for business owners needing funds for asset purchases, expansions, or operational stability.

Final Thoughts

Although CALOSBA currently lacks active state grant programs, this refreshed list of federal Small Business Capital grants in California ensures entrepreneurs have multiple funding options in 2025. Whether you’re recovering from disaster, launching a tech startup, or seeking long-term investment, these programs are vital tools to sustain and scale your small business.

Related