2025–26 California Labor and Workforce Development budget guide: Spending highlights, priorities, and emerging risks

California has earmarked more than $880 million in this year’s state budget for labor and workforce programs—from paying down unemployment debt to modernizing outdated state systems. We break down the major line items, equity initiatives, and key risks.

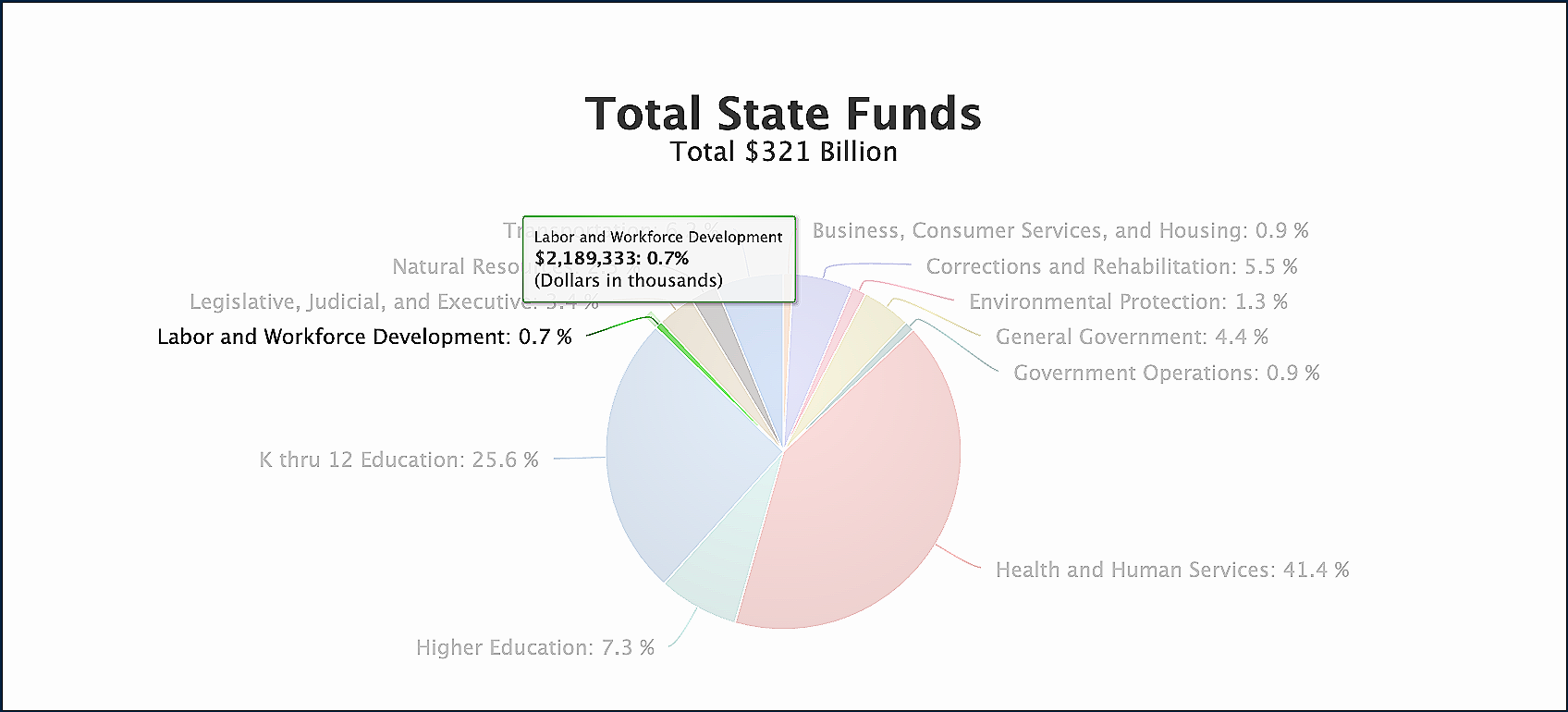

While much of California’s $307 billion state budget for 2025–26 is tied up in healthcare, education, and climate, more than $880 million is earmarked for the state’s labor systems—many of which are under pressure to change.

The Labor and Workforce Development Agency’s slice of the budget is a mix of debt payments, one-time tech upgrades, and targeted programs aimed at expanding job access, especially for low-wage and justice-involved workers.

This guide breaks down what’s in the labor budget, where the money’s going, and what it reveals about the state’s long-term priorities for jobs, benefits, and workforce equity.

Total Spending and Strategic Goals

The Labor and Workforce Development Agency (LWDA) is focused on expanding equity, upgrading digital infrastructure, and supporting safer, more accessible workplaces. In 2025–26, the budget includes over $880 million in targeted adjustments and one-time allocations spanning unemployment insurance, IT modernization, and workforce training.

Key Goals:

- Support pathways to high-quality jobs.

- Modernize outdated technology systems.

- Improve user experience across state-run labor services.

- Expand access to labor protections and training for underserved communities.

Major Budget Items and Program Highlights

$642.8M for Unemployment Insurance Loan Interest

The single largest line item is California’s annual interest payment on its Unemployment Insurance (UI) Trust Fund loan from the federal government. This $642.8 million General Fund expense reflects ongoing pandemic-era debt obligations.

$400M Labor Fund Loan to General Fund

A one-time $400 million loan will be transferred from the Labor and Workforce Development Fund to the General Fund. These funds are currently not allocated for active operations and are being temporarily redirected for budget balancing.

$124.2M for EDDNext (Employment Development Department Modernization)

Now in its fourth year, the EDDNext project will receive $124.2 million (including $62.1M from the General Fund) to continue transforming the state’s benefit systems for unemployment insurance and paid family leave.

$25.8M for DIR Case Management System

The Department of Industrial Relations (DIR) is replacing its Electronic Adjudication Management System, with $25.8 million in one-time funding allocated to continue this upgrade.

Worker Protections and Outreach

$13M for California Workplace Outreach Project

This initiative helps educate workers about their rights and labor protections through targeted outreach campaigns, especially for vulnerable or low-wage communities.

$8.5M Garment Worker Wage Claim Pilot

Eligible nonprofits will receive grants to help garment workers file and process wage claims. The goal is to improve enforcement of California’s landmark garment worker protections.

$18.2M for Cal/OSHA Data Modernization

Modernizing Cal/OSHA’s systems will help the DIR improve workplace safety oversight by replacing outdated tools and streamlining inspections and reporting.

Workforce Training and Access

$18.2M for Apprenticeship Training

Funding from the Apprenticeship Training Contribution Fund will support construction and related trades, helping expand California’s skilled labor pipeline.

$10M for HIRE Program (Reentry Employment)

The Helping Justice-Involved Reenter Employment (HIRE) program provides grants to nonprofits supporting formerly incarcerated individuals with training, employment services, and support.

$5M for Fire Recovery Workforce Support

This one-time funding supports workforce development in Los Angeles and Ventura Counties, where fire recovery efforts are ongoing.

$1M for Regional Career Education Coordination

This pilot program seeks to strengthen collaboration between schools, employers, and training providers by evaluating regional workforce coordination models. It's tied to the state’s broader Master Plan for Career Education.

Other Notable Allocations

- $19.1M for Public Works IT system enhancements (DIR)

- $2.7M and 15 new positions to manage growing caseloads in the Subsequent Injuries Benefits Trust Fund

Analysis and Key Takeaways

The Labor and Workforce Development section of California’s 2025–26 budget reflects a strategic push toward modernization and inclusion—particularly through investments in digital infrastructure, apprenticeships, and reentry pathways.

Here are the key themes to watch:

1. Modernization as a Central Strategy

A large share of the budget is dedicated to updating legacy systems—from the Employment Development Department to Cal/OSHA and the DIR’s adjudication platform. These investments suggest a multi-year commitment to improve efficiency, transparency, and user experience across labor services.

2. Program Delivery Through Community Partners

Grants for apprenticeship training, justice-involved individuals, and garment workers continue the trend of leveraging nonprofits and regional organizations for program delivery. This approach reflects an emphasis on trusted, localized support—especially for historically underserved groups.

3. Alignment With Broader Economic Planning

The inclusion of funding to explore regional career education coordination highlights the state’s intent to synchronize workforce development with long-term economic goals. This connects labor investment with initiatives like the Master Plan for Career Education and California’s State Economic Blueprint.

4. One-Time Funding With Strategic Intent

Although many allocations are one-time, they’re positioned to lay the groundwork for longer-term change. Projects like EDDNext and Cal/OSHA upgrades may not show immediate results, but their success could reshape how the state delivers labor services in the decade ahead.

5. Balanced Investment in Both Systems and People

This year’s budget doesn’t favor infrastructure over individuals—or vice versa. Instead, it spreads funding across digital systems, worker protections, outreach, and employment access. That balance suggests an integrated view of labor policy, where technology upgrades and frontline support go hand in hand.

Five Potential Pitfalls

While the budget outlines a clear vision for modernization and equity, several structural weaknesses and funding choices raise long-term questions. Below are five key concerns that could limit the impact—or sustainability—of the state’s labor investments in 2025–26.

1. Unemployment Insurance Debt Strategy Remains Unclear

While the budget allocates $642.8 million for interest on the UI Trust Fund loan, there’s still no plan to begin repaying the principal. This deferral strategy prolongs California’s financial obligations and could lead to larger interest payments in future years if federal rates rise or if the federal government tightens borrowing conditions. It also leaves the state exposed to potential payroll tax increases under federal FUTA rules if the debt persists.

Risk: Escalating long-term costs and possible federal penalties for employers.

2. Heavy Reliance on One-Time Funding

Many of the budget’s most ambitious initiatives—like EDDNext, Cal/OSHA modernization, and the HIRE program—are supported by one-time allocations. This limits their sustainability and raises concerns about whether projects can be completed or maintained without additional future appropriations.

Risk: Programs may stall midway or lack the ongoing support needed to deliver long-term impact.

3. Labor Fund Loan May Undermine Program Resilience

The $400 million loan from the Labor and Workforce Development Fund to the General Fund is framed as a short-term fiscal maneuver. But drawing down from dedicated labor funds during a time of rising claims and modernization needs could undermine future flexibility if economic conditions worsen.

Risk: Less cushion for unforeseen spikes in unemployment or operational needs.

4. Modest Scale of Equity Programs

Programs like the Garment Worker Wage Claim Pilot and HIRE are highly targeted but relatively small in scale, given the size of the populations they aim to serve. Without scalable mechanisms or broader adoption, these may deliver symbolic wins without systemic transformation.

Risk: Limited reach may reduce effectiveness and lead to fragmented outcomes.

5. Delayed Impact from IT Modernization

Modernizing state labor systems is essential, but the benefits of large IT overhauls (EDDNext, DIR upgrades) may not materialize for years. Meanwhile, claimants and workers continue to face delays and confusing systems, especially during peak demand periods.

Risk: Public frustration and erosion of trust in the state's ability to deliver timely labor services.

Conclusion: Targeted Investments, Long-Term Change

The 2025–26 Labor and Workforce Development budget reflects California’s dual priorities: modernizing critical labor systems and expanding access to economic opportunity. Whether it’s streamlining unemployment benefits or strengthening training for trades and reentry programs, the state is making clear investments in the infrastructure that supports working Californians.

What to Read Next

For a full overview of the entire budget—including health, climate, and housing initiatives—review our related coverages and guides: