Medical debt will no longer be removed from credit reports: Here's how your FICO Score could be impacted

A Texas judge’s ruling keeps medical collections on credit files, denying the 20‑point boost many expected—our guide explains how to calculate the hit and protect your FICO Score.

U.S. District Judge Sean Jordan has vacated the Consumer Financial Protection Bureau’s rule that would have stripped all medical bills from credit reports and barred lenders from using that data. The CFPB expected the rule to delete roughly $49 billion in medical collections from the files of 15 million Americans and raise scores by about 20 points on average.

Because the order is now void, any medical collections of $500 or more—and smaller balances that still slip through—will continue to influence most credit‑scoring models.

Quick self‑assessment: Am I likely to feel a change?

Check the boxes that apply to you:

- I have one or more unpaid medical collections of $500 or higher on my credit report.

- I last took out credit before April 2023, so older, smaller medical debts may still show.

- I plan to apply for a mortgage, auto loan, or personal loan that uses a classic FICO model (usually FICO 8 for mortgages).

- I do not already have serious derogatories such as bankruptcies or foreclosures.

If you marked at least one box, the ruling probably prevents your score from rising—and may keep you below key approval thresholds.

How much could my score move? Point‑by‑point scenarios

Use the table below to approximate the effect:

| Collection profile | Typical FICO 8 penalty | Lost lift from CFPB rule |

|---|---|---|

| One collection under $500 | 0 points (already excluded) | 0 |

| One collection $500–$1,500, 12 months old | 15–25 points | 15–25 |

| Two collections $500–$2,500, 6 months old | 40–60 points | 20–40 |

| Three or more collections $500+, recent | 60–100+ points | 20–50 |

Example A: Single collection, mortgage shopper

- Current FICO 8: 640

- Potential boost lost: +20 points

- Would‑be score: 660

| 30‑yr $200 k mortgage | At 640 | At 660 |

|---|---|---|

| Rate estimate | 6.50 % | 6.25 % |

| Monthly payment | $1,264 | $1,231 |

| Lifetime interest | $255,100 | $243,300 |

Result: roughly $33 more per month and $11,800 in extra interest because the collection stays on file.

Example B: Multiple medical collections, thin credit file

A borrower with two unpaid collections over $500 each often loses 40‑80 points compared with an identical file with no derogatories. If their current FICO 8 is 600, the CFPB’s 20‑point average boost would likely have lifted them to 620—the edge of “fair” credit and the minimum for many FHA loans. Without the rule, they remain in the “sub‑prime” band and pay higher rates (or are declined).

Why medical collections weigh on your FICO® Score

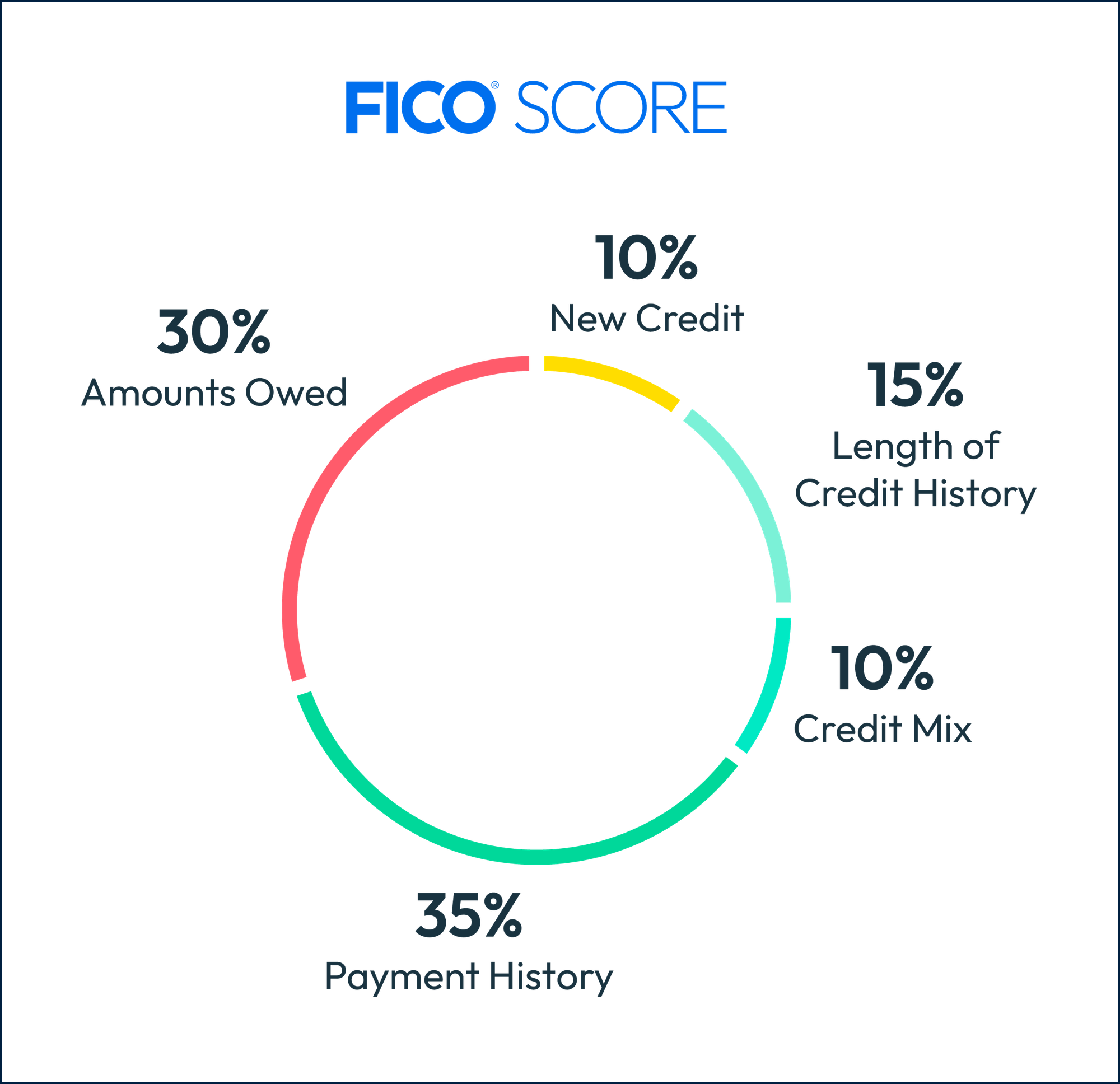

| Credit‑score factor | Weight in a classic FICO Score | How an unpaid medical collection hurts |

|---|---|---|

| Payment history | 35 % | A collection is recorded as a severe derogatory mark, lowering the score even when the balance is small. |

| Amounts owed | 30 % | The collection balance counts toward revolving/utilization debt until it’s paid. |

| New credit & credit mix | 20 % combined | A fresh collection is treated like a new negative account and may skew account diversity. |

FICO 8 (still used by most mortgage lenders) assigns the same penalty to medical and non‑medical collections, while FICO 9/10T reduce the hit or ignore paid medical collections.

Who is less affected

- Debts under $500: Already removed by Equifax, Experian and TransUnion in 2023.

- Paid medical collections: Ignored by FICO 9 and FICO 10T, though many lenders still use FICO 8.

- VantageScore users: Newer VantageScore models also down‑weight or disregard medical collections, so some fintech lenders will see little change.

Practical steps if you have medical debt

- Verify and dispute errors: Collection balances and dates are often wrong. Correcting them can yield a quick score rebound.

- Negotiate “pay for delete”: Some collectors will remove the tradeline in exchange for payment, restoring points even under FICO 8.

- Shop lenders that use FICO 9/10T or VantageScore 4.0: Credit‑card issuers and credit unions are adopting newer models faster than mortgage lenders.

- Monitor utilization: Paying down revolving balances can offset some of the damage from medical collections because “amounts owed” is the second‑heaviest factor.

Bottom line

The judge’s ruling maintains the status quo: medical collections—except small balances already purged—stay on credit files and keep suppressing scores. For the roughly 15 million Americans the CFPB projected would benefit, that means:

- No automatic 20‑point lift

- Continued difficulty qualifying for prime‑rate mortgages and loans

- An outsized impact on borrowers of color and those with thin credit histories

Until Congress changes the Fair Credit Reporting Act or the courts reverse course, consumers will need to rely on traditional credit‑repair tactics or lenders using newer score models to blunt the effect of medical debt on their financial lives.