Ozempic will no longer be covered by Medi-Cal after GLP-1 drugs cut from California's 2025–26 health budget

California will stop covering GLP-1 drugs like Ozempic and Wegovy through Medi-Cal under its new 2025–26 budget, citing rising costs and structural reforms. The move comes after the state reimbursed over $1.6 billion for the drugs in 2024—nearly 10% of all Medi-Cal pharmacy spending.

California will end Medi-Cal coverage for GLP-1 drugs, including Ozempic and Wegovy, starting January 1, 2026, as part of its newly enacted 2025–26 budget. The move eliminates reimbursement for some of the most expensive and widely used medications in the state’s Medicaid pharmacy program.

The decision, buried within the Department of Health Care Services’ (DHCS) cost-saving adjustments, comes after a year in which these drugs accounted for more than $1.6 billion in Medicaid reimbursements statewide.

According to federal data, Ozempic and Wegovy together made up nearly 10% of all Medi-Cal drug reimbursements in 2024. The figure underscores both the widespread use of these medications and the financial pressure they exert on public insurance systems.

Learn how this cut aligns with the broader fiscal realignment of California’s 2025-26 Health and Human Services (HHS) budget.

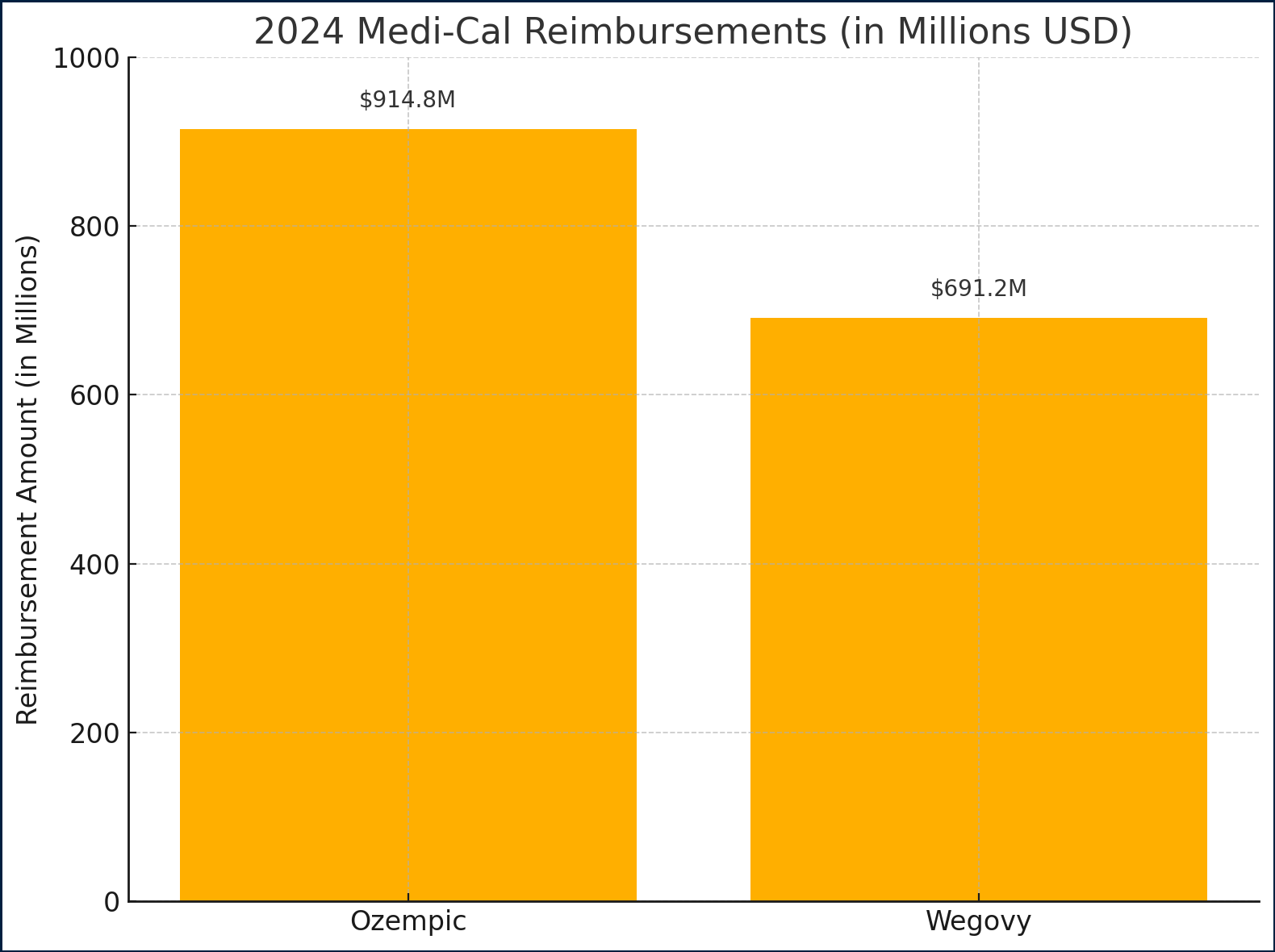

The Cost of Ozempic and Wegovy in 2024

In 2024, California’s Medi-Cal program reimbursed a staggering $1.61 billion for two GLP-1 drugs: Ozempic and Wegovy. Together, these medications accounted for 9.97% of the state’s total Medicaid reimbursements—an outsized footprint for just two drugs among thousands covered.

Here’s how that total breaks down:

- Ozempic: $914.8 million

- Wegovy: $691.2 million

- Combined: $1.606 billion

- Total Medi-Cal Drug Spend in 2024: $16.1 billion

This level of spending helped drive the state’s decision to remove GLP-1s from its covered Medi-Cal formulary in 2025–26.

Ozempic Quarterly Spend and Utilization Trends

Analysis of Medicaid drug data shows that most of California’s Ozempic reimbursements in 2024 came through Fee-For-Service Utilization (FFSU), rather than Managed Care (MCOU). FFSU accounted for over 98% of the dollars spent and prescriptions filled.

The two most frequently reimbursed formulations were Ozempic 0.25mg and 1mg, representing the majority of prescriptions across all four quarters.

Utilization ramped up quickly over the year:

- Q1 2024: $89.8M reimbursed

- Q2 2024: $88.5M

- Q3 2024: $111.5M (highest)

- Q4 2024: $93.2M

Notably, Q3 2024 saw over 108,000 claims for Ozempic 0.25mg alone, signaling both accelerating demand and rising per-unit costs. Even as some utilization tapered in Q4, costs remained elevated due to increasing reimbursement rates per prescription.

Wegovy Quarterly Spend and Utilization Trends

While Ozempic drew more attention and total spend, Wegovy represented a significant fiscal burden in its own right, with over $691 million reimbursed across four quarters in 2024.

Reimbursement data shows a marked increase in spending in Q3 and Q4, likely due to more aggressive prescribing for weight loss:

- Q1 2024: ~$65M

- Q2 2024: ~$70M

- Q3 2024: ~$170M

- Q4 2024: ~$190M

Unlike Ozempic, Wegovy reimbursements were more evenly distributed across dosage levels, from 0.25mg up to the full 2.4mg dose. This suggests a steady population progressing through the drug’s step-up regimen, rather than just trial usage.

Despite having fewer claims than Ozempic, Wegovy’s per-claim cost was often higher, making it an equally difficult expense to sustain within Medi-Cal’s limited pharmacy budget.

How We Got Here: Budget Realignment and Cost Pressures

The decision to end GLP-1 coverage didn’t come in isolation. It is one of dozens of adjustments outlined in California’s $307 billion HHS budget for 2025–26, which aims to curb spending growth and protect the General Fund amid rising service costs.

The current fiscal strategy marks a turning point: from expansion to cost containment. Medi-Cal, which now covers nearly 15 million Californians, has seen costs balloon in recent years—driven in part by increased enrollment, inflation, and the explosive uptake of drugs like Ozempic and Wegovy.

Within the Department of Health Care Services, policymakers framed the 2025–26 budget as a path to long-term balance, noting the need to align program spending with available state revenue. That alignment has translated into hard choices. In addition to GLP-1 coverage cuts, the budget also reinstates asset tests for seniors, restructures provider payments, and eliminates several supplemental programs.

What's Next

With the 2025–26 budget now enacted, coverage for Ozempic and Wegovy will expire no later than January 1, 2026, unless the Department of Health Care Services (DHCS) issues new carve-outs or exemptions.

A few key developments to watch:

- Will DHCS walk this back? Some analysts believe the state may reinstate GLP-1 access under narrower criteria if public outcry grows.

- Legal challenges may emerge. Advocates for diabetes patients and disability rights groups could challenge the policy under federal Medicaid access standards.

- Rebate negotiations are possible. Manufacturers may offer price concessions to regain access to California’s massive Medicaid market.

- Other states are watching. California often leads national trends—if this cut holds, other large states may follow.

Until then, the future of GLP-1 access for Medi-Cal recipients remains deeply uncertain.