Hotel demand growth returns to California’s gateway cities in 2025; rural and drive-to demand stagnates

California’s urban hotel markets are set for a strong recovery in 2025, with business and international travel driving demand in Los Angeles, San Francisco, San Diego, and Orange County.

California’s gateway cities are projected to see stronger hotel demand growth than non-urban areas in 2025.

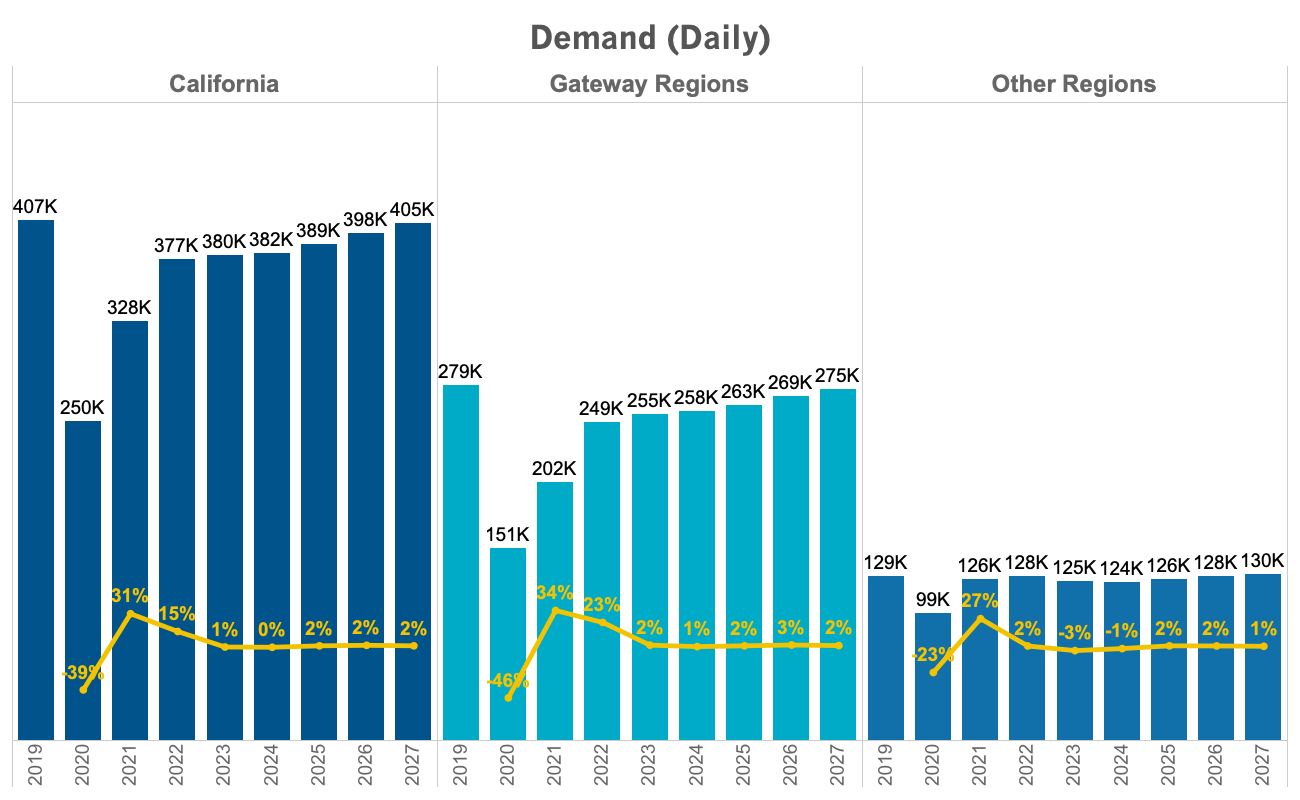

According to Tourism Economics' new State and Regional Lodging Forecast, California hotel room demand in major metropolitan regions is expected to increase by 1.8%, compared to slower or stagnant growth in rural and drive-to destinations like the Central Valley, High Sierra, and Inland Empire.

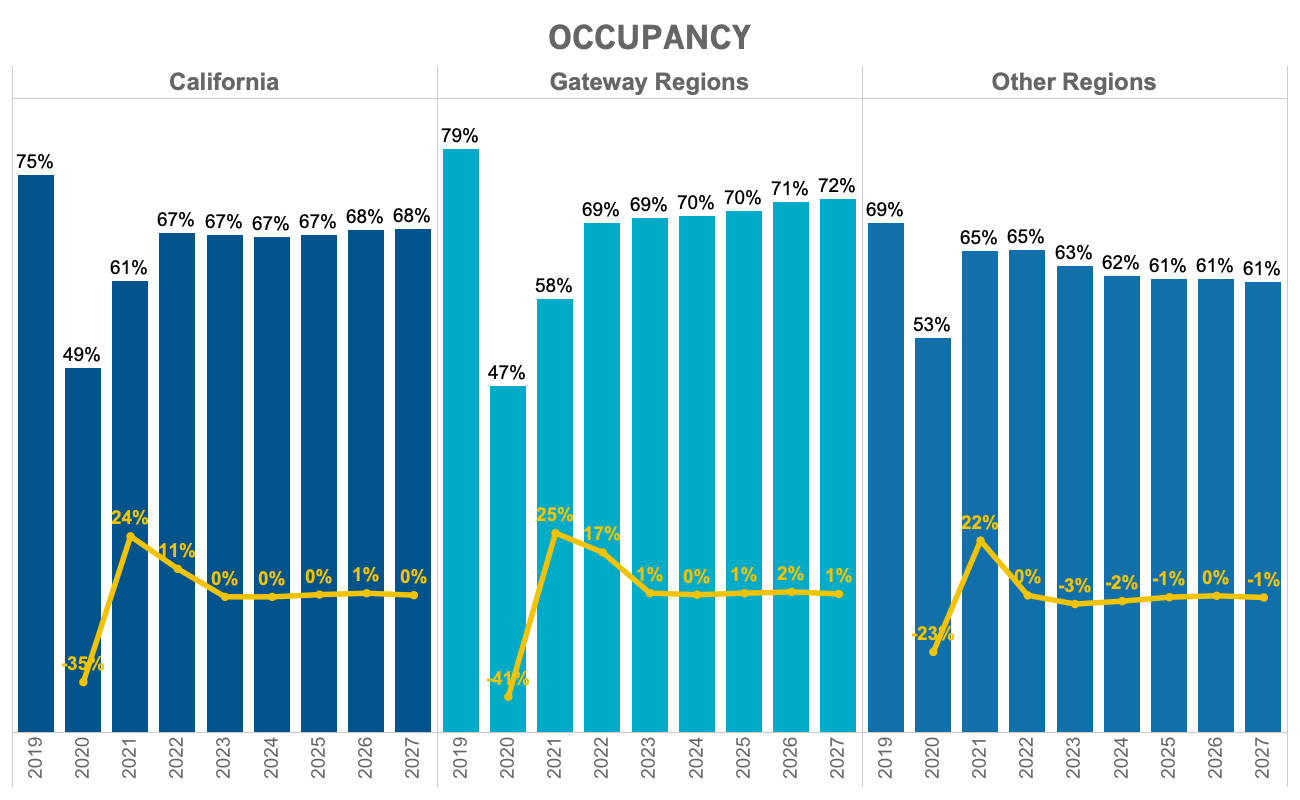

California’s hotel industry is seeing a shift in demand, with occupancy rates and daily room demand increasing in gateway regions like Los Angeles, San Francisco, San Diego, and Orange County. Charts: VisitCalifornia.com.

This shift marks a continued reversal from pandemic-era travel trends, where rural and drive-to locations saw a surge in tourism as travelers avoided dense city centers. With consumer confidence improving and business travel rebounding, demand is now shifting back to California’s primary urban hubs.

Hotel Occupancy Trends for 2025

Occupancy rates in Los Angeles, San Diego, Orange County, and San Francisco are expected to rise slightly in 2025 as room demand outpaces new hotel supply. The annual occupancy rate for California’s gateway cities is forecast to increase by 0.7%, while non-urban regions may continue to struggle with lower demand and slower price growth.

However, industry analysts note that weekend travel demand remains weaker than pre-pandemic levels, with urban hotels relying more on weekday corporate bookings and international visitors to drive performance.

The Role of Business and International Travel in the Recovery of Urban Lodging Demand

Several key factors are driving the renewed demand for urban lodging:

- Return of Business Travel – Business travel and weekday hotel demand continue to strengthen in California's gateway cities. The group segment, which includes corporate bookings, has outpaced transient travel in growth for occupancy, ADR, and RevPAR. Hotels in San Francisco and Los Angeles are particularly benefiting from higher weekday occupancy, signaling a continued return of corporate and industry-related travel.

- Group and Event Travel Growth – Group bookings have rebounded sharply, with major conventions and industry events driving a projected 1.8% increase in hotel demand in 2025. The weekend group travel segment, typically associated with weddings, reunions, and social events, remains weaker than expected, but corporate event-driven lodging is bolstering occupancy in urban markets.

- International Tourism Resurgence – California's inbound international travel is forecast to increase by 12.1% in 2025, with the largest volume of visitors arriving from China, Canada, and the UK. Key attractions like Hollywood, Disneyland, and San Francisco’s waterfront are expected to drive substantial increases in demand for upscale and luxury hotels, reinforcing California's role as a top destination for global travelers.

- Urban Hotel Price Adjustments – The Average Daily Rate (ADR) in gateway cities is projected to rise by 2.3% in 2025, reaching $208.64 in key metropolitan areas like Los Angeles and San Francisco. While pricing power remains constrained compared to pre-pandemic trends, hotel operators are strategically adjusting rates to maintain strong occupancy while maximizing revenue.Hotel Occupancy Trends for 2025

Why Growth Is Stagnant in Rural and Drive-To Destinations

While urban lodging markets in Los Angeles, San Francisco, San Diego, and Orange County are seeing a resurgence in demand, rural and drive-to markets like the Central Valley, High Sierra, and Inland Empire are experiencing stagnation or even slight declines in occupancy and revenue growth. Key reasons include:

- Demand Normalization After Pandemic-Driven Booms – Many rural and drive-to markets saw early recoveries in 2021 and 2022 as travelers opted for road trips and outdoor tourism when international and urban travel were restricted. As global travel normalizes, demand in these areas is no longer growing at the same pace, leading to flat or declining occupancy rates.

- Weaker Business and Group Travel – Unlike urban destinations that are benefiting from corporate events, conventions, and international tourism, rural markets rely more on domestic leisure travelers and small-scale events. With business travel shifting back to major metro hubs, weekday demand in rural areas remains weak.

- Limited Pricing Power in ADR Growth – Hotel operators in the Central Valley and High Sierra have struggled to raise rates due to price-sensitive leisure travelers. While urban areas are seeing ADR increases of 2.3% to 2.5%, rural destinations are growing at a slower rate (~1.4%), which limits revenue growth.

- Supply Growth Outpacing Demand – In regions like the Inland Empire, hotel room supply is increasing at a faster rate than demand, leading to lower occupancy levels despite a steady number of visitors. For example, hotel supply in the Inland Empire is projected to grow 4.6% in 2025, but demand is only increasing by 1.4%, leading to a decline in occupancy.

- Economic Pressures on Lower-Income Travelers – Inflation and higher costs of living have hit middle- and lower-income households harder, affecting discretionary spending on regional leisure travel. Since many rural and drive-to hotels rely on budget-conscious travelers, they are seeing slower recovery compared to urban markets that attract higher-spending business and international guests.

Key Statistics on Rural Market Stagnation

- Central Valley: Occupancy projected to decline from 59.4% in 2024 to 58.7% in 2025, despite a 2.8% increase in room supply.

- High Sierra: Occupancy only rising by 0.5% in 2025, compared to urban growth of 1.8%+.

- Inland Empire: Hotel room demand up just 1.4% in 2025, but supply growing 4.6%, leading to a 3.1% drop in occupancy.

These findings confirm that rural and drive-to destinations are seeing stagnation due to a combination of demand normalization, weak business travel, limited pricing power, and economic pressures on leisure travelers. Meanwhile, urban markets are benefiting from the return of high-spending international and corporate guests.

How Travelers Can Benefit from These Shifts

For those planning travel in 2025, these trends could present opportunities to find better deals in certain areas:

- More availability for weekend leisure stays as business travelers fill rooms during weekdays.

- Higher competition among hotels in gateway cities could lead to targeted promotional offers, particularly during off-peak seasons.

- Luxury hotel segment remains strong, with high-end properties seeing sustained demand from international visitors.

Looking Ahead

With urban centers reclaiming their position as the strongest-performing hotel markets in California, lodging industry analysts remain optimistic about 2025. Corporate and group travel demand is expected to continue rising, and if inflation pressures ease further, consumer confidence could drive even stronger occupancy rates in major metro areas.

Meanwhile, non-gateway regions will need to adapt to shifting travel patterns, potentially by focusing on niche tourism markets, outdoor experiences, and off-season promotions.