2025 California State Disability Insurance (SDI) tax guide

The State Disability Insurance (SDI) withholding rate has increased to 1.2% for 2025, with no wage cap. Learn how California SDI taxes apply to your paycheck this year.

For the most current rules, tax schedules, and eligibility tiers, please refer to our updated 2026 series:

- 2026 California SDI Tax Guide–Coverage of the new 1.3% withholding rate and employer compliance rules.

- 2026 California SDI Benefits Guide–Details on updated 2026 payout tiers and the $1,765 weekly cap.

- 2026 California Pregnancy & Maternity Guide–A guide to the standard 2026 timelines and the new "vacation choice" policy.

Original article begins below.

In 2025, all wages earned in California are subject to State Disability Insurance (SDI) contributions—with no maximum wage cap for the second straight year. This year’s SDI tax rate is 1.2%, meaning California workers now contribute more than ever to support disability and Paid Family Leave benefits.

In this guide, we explain how SDI tax is calculated, who pays it, and how it fits into California’s broader system of payroll taxes. For benefit details—including new payout levels in 2025—see our 2025 SDI benefits guide.

What is SDI and how is it taxed?

California’s State Disability Insurance (SDI) program provides partial wage replacement to workers who can’t work due to:

- Non-work-related illness or injury

- Pregnancy and childbirth

- Bonding with a new child or caring for an ill family member (Paid Family Leave)

Unlike some other payroll taxes, SDI is funded entirely through employee wage deductions. Employers are responsible for withholding the correct amount, remitting it to the Employment Development Department (EDD), and ensuring compliance.

2025 SDI tax rate and wage base

For 2025:

- SDI withholding rate: 1.2% of gross wages

- Wage limit: None (all wages are subject to SDI)

- Maximum annual contribution per employee: Unlimited (depends on total wages)

This continues the change that began in 2024, when Senate Bill 951 removed the taxable wage ceiling for SDI contributions to expand benefits for low- and middle-income Californians.

How SDI fits into California payroll taxes

SDI is one of four state payroll taxes:

| Tax Type | Who Pays It | Purpose |

|---|---|---|

| Unemployment Insurance (UI) | Employer | Temporary support for laid-off workers |

| Employment Training Tax (ETT) | Employer | Funds employee training and skill development |

| State Disability Insurance (SDI) | Employee | Wage replacement during non-work disability or family leave |

| Personal Income Tax (PIT) | Employee | Funds state services like schools, parks, and healthcare |

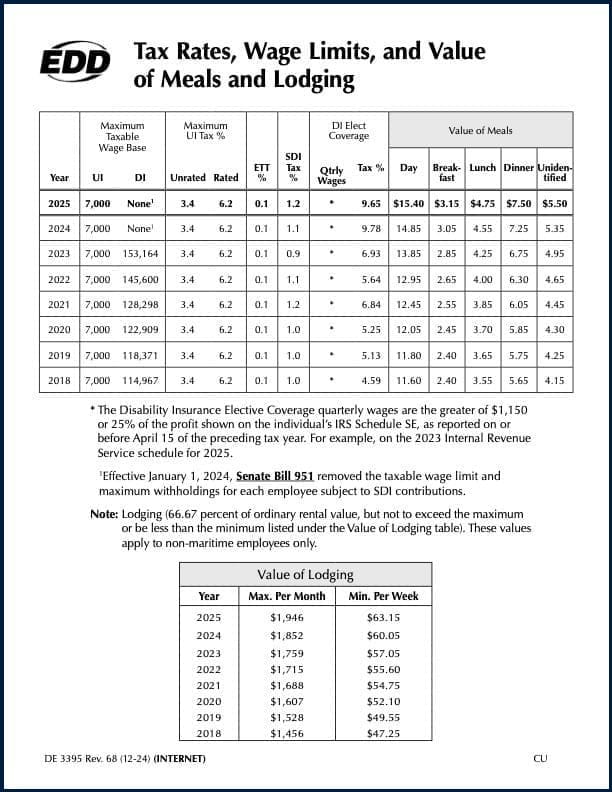

Chart: SDI and Payroll Tax Rates Over Time

The official EDD chart shows that the SDI tax rate has nearly doubled in just three years, from 0.9% in 2023 to 1.2% in 2025. At the same time, the removal of the SDI wage cap means high earners will contribute significantly more toward the program.

Why did the SDI wage cap go away?

The elimination of the wage cap was part of Senate Bill 951, passed in 2022 and fully implemented in 2024. The goal is to ensure higher benefits and more equitable access, especially for middle-income earners who previously received lower-than-expected wage replacement rates.

Employer obligations for SDI

Employers must:

- Withhold 1.2% of gross wages from all employees

- Remit SDI withholdings to the EDD regularly

- Keep records of all wages paid and taxes withheld

- Inform employees about SDI and Paid Family Leave options

Failure to properly withhold and report SDI may result in penalties.

SDI vs. Paid Family Leave: What’s the difference?

Paid Family Leave (PFL) is funded by SDI but used for different life events. You may qualify for PFL if you're:

- Caring for a seriously ill family member

- Bonding with a new child

- Participating in a qualifying military event

Your employer withholds the same 1.2% for both programs; your eligibility is determined by the reason you file.

Summary of 2025 Key Figures

| Annual Income | Highest Quarterly Wages | Weekly Benefit Amount |

|---|---|---|

| Less than $1,200 | Less than $300 | Not eligible |

| $1,200 – $2,889.96 | $300 – $722.49 | $50 |

| $2,890 – $62,025.60 | $722.50 – $15,506.40 | 90% of weekly wages |

| $62,025.64 – $79,747.20 | $15,506.41 – $19,936.80 | Flat rate: $1,074/week |

| Over $79,747.20 | Over $19,936.81 | 70% of weekly wages, max of $1,681/week |

Stay Updated

For more information, see our related guides: