Here's how a war with Iran could affect the US economy, according to precedents from the Iraq War

The U.S. strike on Iranian nuclear facilities marks a pivotal escalation with uncertain consequences. Drawing on two decades of data from the Iraq War, we explore how another Middle East conflict could reshape the American economy for years to come.

As the United States enters a dangerous new chapter in its decades-long tensions with Iran—launching direct strikes on Iranian nuclear facilities and potentially drawing itself into a broader Middle Eastern war—questions about the long-term economic consequences loom large. While political leaders in Washington insist that the military action is narrowly targeted and meant to deter escalation, history tells a different story.

The Iraq War, specifically, offers a cautionary tale.

What began in 2003 as a swift campaign to remove Saddam Hussein became a generational conflict, costing trillions of dollars and reshaping the U.S. economy in profound, often underappreciated ways.

Today, many of the same conditions that made Iraq so costly—debt-financed warfare, a long-term commitment to veterans' care, energy market volatility, and the diversion of resources from domestic priorities—are again in play.

This article draws on two key sources: a 2008 report from the U.S. Joint Economic Committee, which assessed the Iraq War’s early economic toll, and a 2023 study from Brown University’s Costs of War project, which accounts for the full financial burden of the war two decades later.

Together, they offer critical insight into what another major conflict in the Middle East—this time with Iran—could mean for the U.S. economy. With oil prices rising and threats of retaliation mounting, those lessons have never been more urgent.

What the Iraq War Tells Us About the Potential Economic Impact of a War with Iran

The Iraq War offers a clear and deeply researched precedent for evaluating the likely economic consequences of another large-scale conflict in the Middle East. If the United States were to become embroiled in a prolonged war with Iran, the financial burden could echo—and in some areas surpass—the fiscal trauma of Iraq.

1. Direct Budgetary Costs Would Be Enormous and Long-Term

The Iraq War began with expectations of a swift and relatively low-cost campaign. Instead, it became a decades-long drain on the U.S. Treasury. As the 2023 Brown University report states:

“Total U.S. costs [as of 2023] are estimated at about $1.79 trillion, not including funds requested for FY2024. If the costs of future U.S. veterans medical and disability care are included, these costs will reach about $2.89 trillion by 2050.” – Costs of War (2023)

The 2008 Joint Economic Committee estimated costs would balloon due to “long-term obligations,” such as interest on borrowed funds and veteran care:

“By any measure, the economic costs of continuing our current course in Iraq would be enormous.” – Joint Economic Committee (2008)

A war with Iran—a larger, more populous, and better-armed nation than Iraq—would almost certainly involve even greater initial and long-term expenditures, particularly given the likely need for air superiority, naval deployment in the Strait of Hormuz, cyber defense, and expanded troop presence across the region.

2. Veterans’ Care and Interest Payments Compound the Burden

A central insight from the 2023 report is that the costs do not stop when combat ends. For example, veterans’ care and disability obligations are projected to extend well beyond 2050, with more than a $1.1 trillion in future costs projected.

In a conflict with Iran, we should anticipate another generation of American service members needing long-term care, especially if the war escalates to include missile attacks on U.S. bases in the Middle East. That would mean new VA obligations lasting decades.

Additionally, both reports stress the cost of borrowing to fund war. The Iraq War was largely financed through deficit spending:

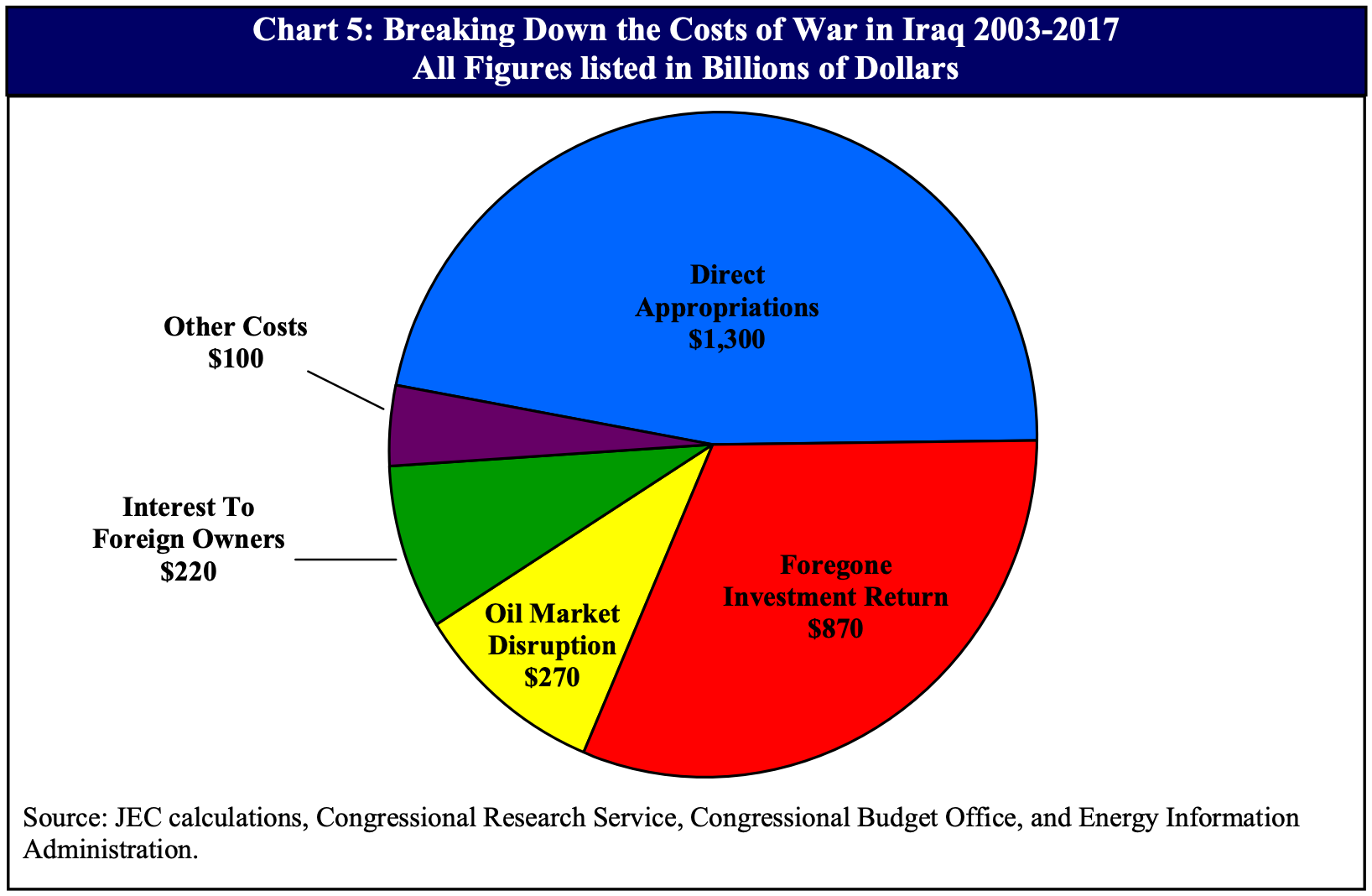

“Substantial Iraq-related costs have been borrowed from foreigners,” including **$220 billion in interest paid overseas by 2008. – Joint Economic Committee (2008)

War with Iran would likely require similar, if not greater, deficit spending—especially amid elevated interest rates—further bloating the national debt and diverting taxpayer money to interest payments.

3. Oil Market Disruption Would Trigger Global Economic Shocks

One of the clearest immediate parallels from Iraq is the volatility of oil prices. The 2008 report noted:

“Both the direct effect of the war in reducing Iraqi oil production and the indirect effect of creating greater instability in the Middle East can act to increase oil prices. Relatively small increases in oil prices can have substantial economic effects. – Joint Economic Committee (2008)

An AP report confirms that oil prices have already begun rising in response to U.S. strikes on Iranian nuclear sites and Iranian threats to close the Strait of Hormuz, through which ~20% of the world’s oil supply flows.

A broader war with Iran would likely cause severe spikes in energy prices, with downstream effects on transportation, production costs, inflation, and global supply chains, similar to or worse than those triggered during the Iraq War years.

4. Opportunity Costs Will Undermine Domestic Investment

Another long-term economic consequence of the Iraq War was the diversion of resources away from domestic priorities. As the 2023 Brown report observes:

“Spending on the war crowded out investment in U.S. infrastructure, health care, and education.” – Costs of War (2023)

Any significant new war effort with Iran would almost certainly repeat this pattern, especially if it becomes prolonged or demands a larger conventional military presence.

Even the 2008 report warned that “the war is likely to cause long-term harm to the U.S. economy by diverting public and private resources from productive uses.”

4. Geopolitical Overreach Amplifies Financial Exposure

The Iraq War also demonstrated the risk of underestimating the duration and scale of military commitments. What began as a regime-change operation in March 2003 turned into an 18-year military engagement that cost the United States an estimated $2.89 trillion, including $1.79 trillion in direct war appropriations and nearly $500 billion in interest payments on borrowed funds. The U.S. also faces hundreds of billions more in future veteran care costs extending through at least 2050.

Today, while the AP reports U.S. claims that the strike in Iran was narrow and defensive, history suggests that once regional retaliation, proxy attacks, or escalation begin, the costs—military and economic—spiral quickly.

The same will almost certainly hold true for any conflict with Iran if it is not quickly de-escalated.

Conclusion: The Price of Engagement

If the U.S. expands its military engagement with Iran, the economic consequences are likely to mirror and exceed those of the Iraq War—particularly in terms of long-term debt, energy prices, veterans’ care, and reduced domestic investment.

In short, Iraq proved that wars are always more expensive than advertised, and their costs are generational. Any future conflict—especially with a nation like Iran—must be assessed not only in military terms but in the staggering economic liabilities it will impose on the U.S. economy and future taxpayers.

Let me know if you’d like this formatted into an article, op-ed, or brief for publication or distribution.